pa unemployment income tax refund

100 free federal filing for everyone. If filing as unmarried use Table 1.

Wfh And Your Taxes Wfh The New Normal What The Heck

Thats dictated by the PATH Act.

. You will be prompted to enter. Record the your PA tax liability from Line 12 of your PA-40. This tax form provides the total amount of money you were paid in benefits from the Office of Unemployment Compensation in 2021 as.

Learn More About UCMS. Ad See How Long It Could Take Your 2021 State Tax Refund. Just Three Easy Steps.

Record tax paid to other states or countries. Check the status of your Pennsylvania state refund online at httpswwwmypathpagov. Heres the best number to call.

Get Information About Starting a Business in PA. See If You Qualify To File State And Federal For Free With TurboTax Free Edition. The most recent batch of unemployment refunds went out in late july 2021.

The Department of Revenue e-Services has been retired and replaced by myPATH. Amending Tax and Wage Information Changes to previously filed tax and wage information can be made by accessing the Quarterly Reporting portal in UCMS and selecting Amend Quarterly Report. Irs unemployment tax refund august update.

Even though the chances of speaking with someone are slim you can still try. For questions regarding the file specifications contact the Office of UC Tax Services at 1-866-403-6163 option 2. In the Notifications area.

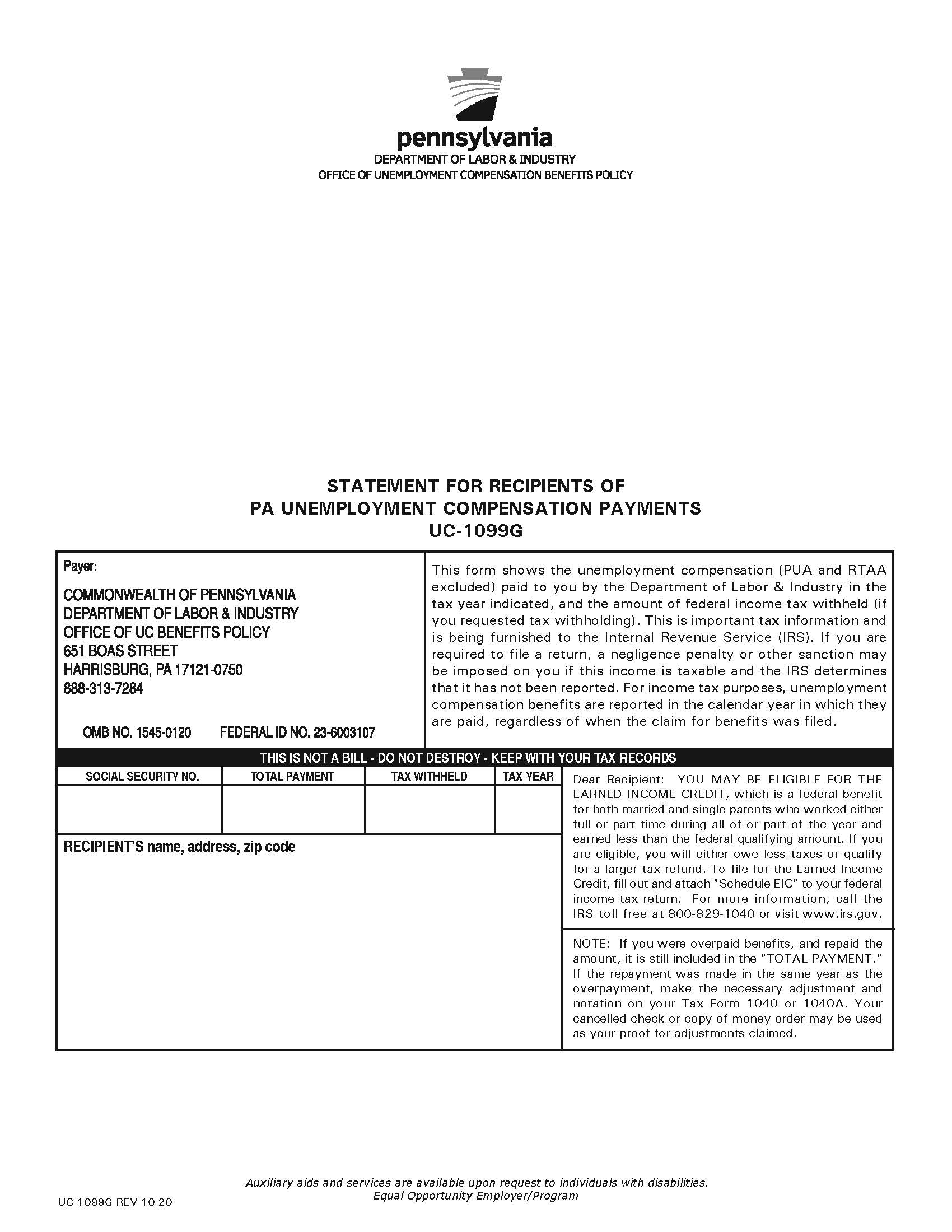

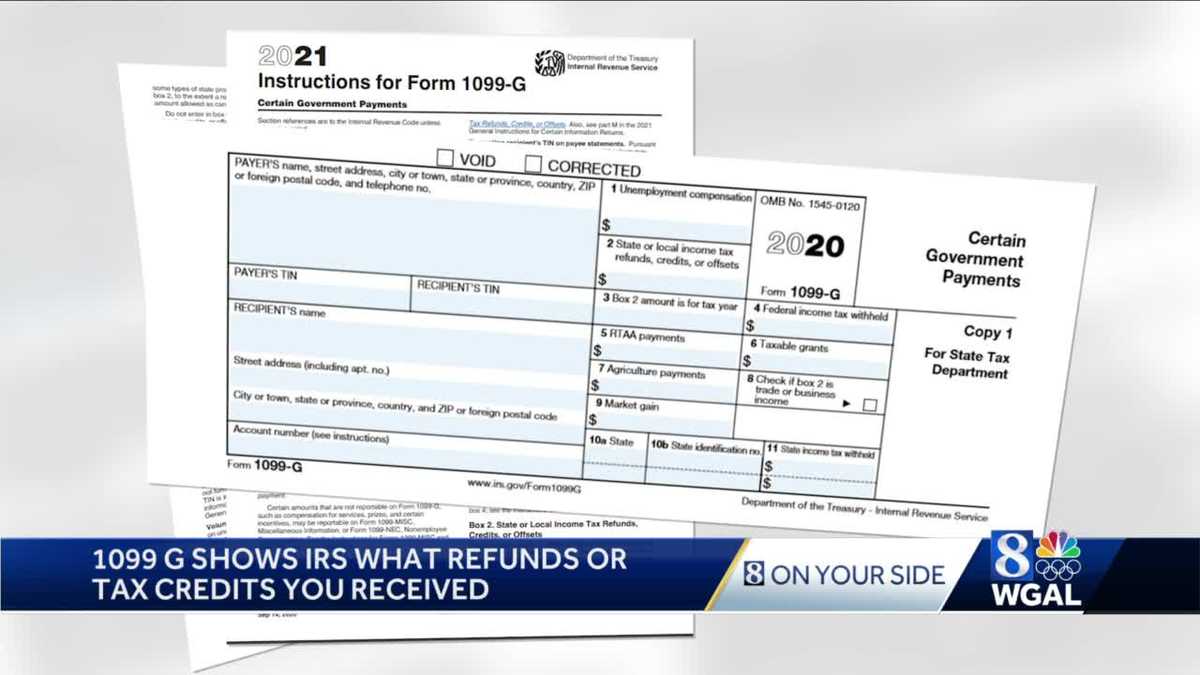

Your Social Security number. 1099-G Tax Form Information you need for income tax filing T he Statement for Recipients of Certain Government Payments 1099-G tax forms are mailed by January 31 st of each year for Pennsylvanians who received unemployment benefits. The IRS will also apply any overpaid money to outstanding tax bills.

Dont delay sign up today. The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in 2020 unemployment. Apply for a Clearance.

Do taxpayers need to file an amended return. Register to Do Business in PA. If you received more than 10200 in unemployment benefits that will be taxed.

The agency is juggling the tax return backlog delayed stimulus checks and child tax credit payments. No one claiming the ACTC Additional Child Tax Credit or EITC Earned Income Tax Credit has received or will receive a direct deposit before February 15th. Subtract Line 13 from 12.

The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns. If Line 13 is blank enter the amount from Line 12. There are no exceptions or alternative interpretations period.

The first refunds are expected to be in May and will continue into the summer months. The IRS says not to call the agency because it has limited live assistance. Report the Acquisition of a Business.

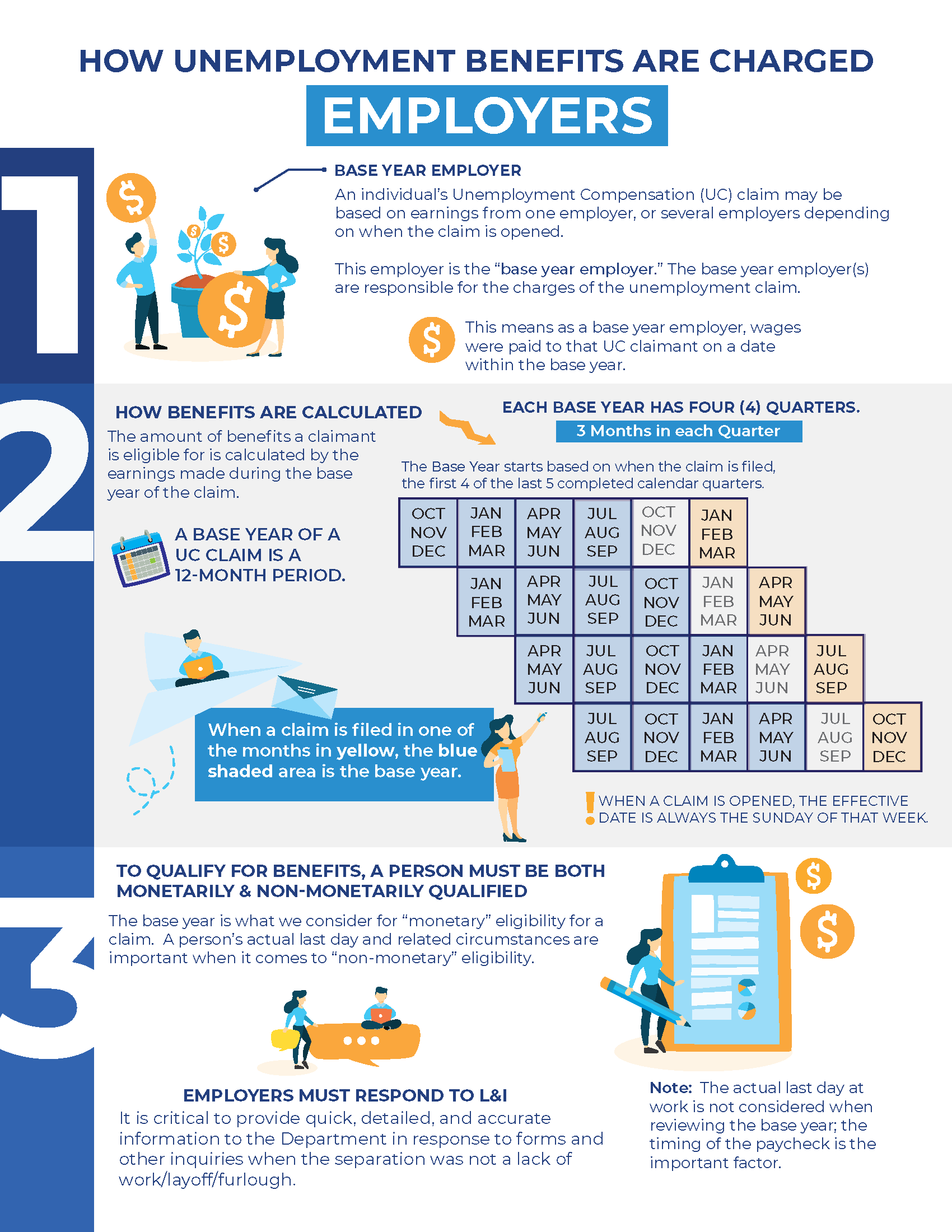

The applicable period for emergency unemployment relief for governmental entities and nonprofit organizations was extended to weeks of unemployment ending on or before September 6 2021. BUT the first 10200 of unemployment benefits you received is not taxable by the IRS. An estimated 13 million taxpayers are due unemployment compensation tax refunds.

MyPATH functionality will include services for filing and paying Personal Income Tax including remitting correspondence and documentation to the department electronically. Register for a UC Tax Account Number. See Why Were Americas 1 Tax Preparer.

Earnings reported on Schedule K-1 Sub-Chapter S Form 1120-S are not taxable on the local level and therefore should not be used in. Your refund status will be updated daily. July 28 2021.

File and Pay Quarterly Wage and Tax Information. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. If none leave blank.

Appeal a UC Contribution Rate. This is not a new thing weve been dealing with this since 2016. Select Employer ProfileProfile Maintenance or Representative ProfileProfile Maintenance on the left menu.

Login to your UC Management System UCMS account. Premium federal filing is 100 free with no upgrades for unemployment taxes. Change My Company Address.

The amount of your requested refund. The non-resident rate of the municipality in which you work is higher than your resident tax rate therefore the additional tax withheld remains in the jurisdiction you work. Ad File your unemployment tax return free.

The irs is recalculating refunds for people whose agi is 150k or below and who filed before the tax law that changed the amount of unemployment that. Unemployment benefits are like wages and you must report it as income on your tax return if you earned enough income to need to file taxes. Additionally the amount of emergency relief for weeks of unemployment beginning after March 31 2021 increased from 50 of the compensation paid to 75.

For more information on myPATH visit revenuepagovmypathinformation. Learn How Long It Could Take Your 2021 State Tax Refund. To fill in Line 15 refer to the Eligibility Income Tables or Page 36 of the PA-40 tax booklet.

Services for taxpayers with special hearing andor speaking needs are available by calling 1-800-447-3020 TT. Check For The Latest Updates And Resources Throughout The Tax Season. Ad File Your State And Federal Taxes With TurboTax.

Losses from a business cannot be used to offset wages for 2009 and forward.

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Unemployment Benefits And Taxes Here S What To Do About Incorrect Tax Forms And Other Issues The Denver Post

Covid Bill Waives Taxes On 20 400 Of Unemployment Pay For Couples

How To Get A Refund For Taxes On Unemployment Benefits Solid State

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

1099 G Tax Form Why It S Important

Carrera De Contaduria Publica Contaduria Publica Contaduria Y Finanzas Educacion Y Cultura

:max_bytes(150000):strip_icc()/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Save Time Let Landa Associates Handle Your Payroll Payroll Software Payroll Taxes Payroll